Related Articles

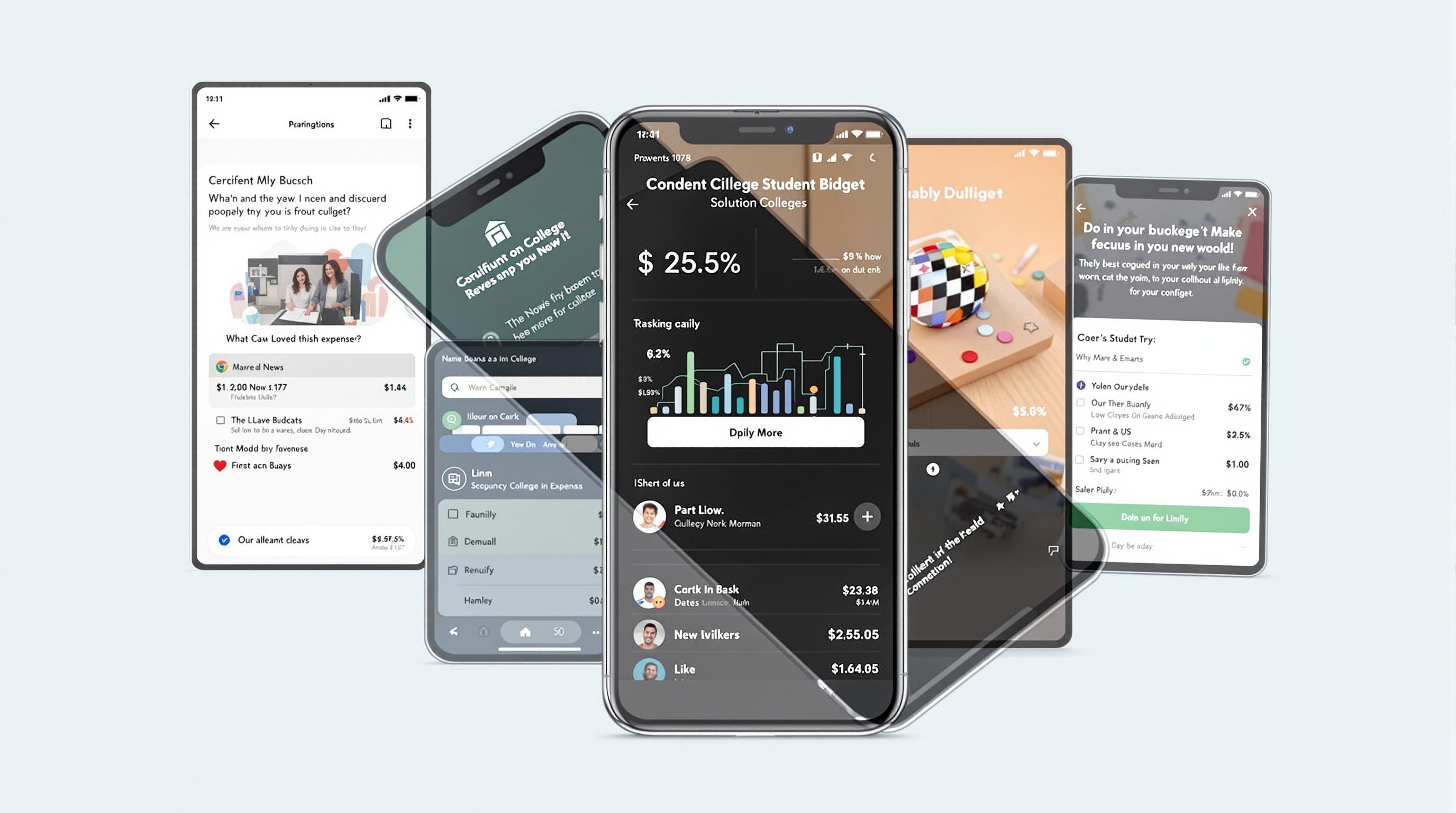

- 7 Game-Changing Student Budget Apps Released Since 2019 That Slash College Living Expenses

- The Silent Toll of Campus Health Services: Unpacking the Overlooked Expenses Students Face Beyond Tuition

- Examining Virtual Tour Accessibility Challenges for Neurodiverse and Disabled Students in Higher Education

- The Role of Virtual Campus Visits in Shaping Student Identity and Community Belonging from Afar

- How Procrastination Patterns Shape College Application Outcomes: Analyzing the Role of Timing in Student Decisions

- How Seasonal Patterns Influence Decision-Making Mindsets During Critical College Application Phases

The Silent Toll of Campus Health Services: Unpacking the Overlooked Expenses Students Face Beyond Tuition

The Silent Toll of Campus Health Services: Unpacking the Overlooked Expenses Students Face Beyond Tuition

Students often assume tuition fees cover most of their college expenses, but the reality is far more complex. Hidden costs, especially those related to campus health services, quietly add up, straining budgets and affecting student wellness.

Story from the Trenches: Amanda’s Unexpected Medical Bills

Amanda, a 19-year-old sophomore at a mid-sized university, always believed her health center fees were included in her tuition. That belief shattered when a routine visit for severe seasonal allergies turned into a $250 out-of-pocket expense after medications, specialist referrals, and lab tests. Like many students, Amanda had opted for the basic university insurance plan, unaware of the limitations and unexpected charges that awaited her.

The Hidden Health Expenses Beyond Tuition

When universities advertise their tuition and fees, they prominently highlight tuition, housing, meal plans, books, and sometimes insurance. However, campus health services are often perceived as “free” or fully covered, despite the reality that many services require co-pays, deductibles, or full payments. According to a 2022 study by the National College Health Association (NCHA), nearly 40% of students reported paying out-of-pocket for health services on campus in the past year, with many spending upwards of $300 annually beyond what their tuition covers.

The Financial Strain of Mental Health Services

Let’s have a heart-to-heart. Mental health on college campuses has received much-needed attention lately, but services are often overwhelmed and underfunded. Students may find quick free counseling sessions available, but longer-term therapy or psychiatric care frequently falls outside of the coverage umbrella or involves waiting lists that push students to seek off-campus providers at much higher costs. According to the American College Health Association, about 30% of students who sought mental health counseling reported financial barriers as a primary concern.

Informal Insight: A Conversation with Health Providers

Dr. Luis Hernandez, a campus health director at a large urban university, shared an honest perspective: “We strive to provide comprehensive care, but budget constraints and insurance complexities mean students often face unexpected costs. Some avoid care altogether because of the confusion and expense, which is heartbreaking.” This candid admission highlights the systemic issues behind these hidden expenses, many of which students are ill-prepared to handle.

Why Aren’t These Costs Better Communicated?

Transparency is a major problem. Universities tend to offer a cursory overview of health fees bundled within general service fees, rarely detailing the potential spectrum of additional charges. A 2021 report by The Education Trust emphasized that less than 25% of colleges provide detailed information on possible out-of-pocket costs related to on-campus health care. Without clear guidance, students and their families enter campus life unprepared for these financial realities.

The Ripple Effects on Academic Performance and Student Life

When students must divert precious funds to cover unexpected health-related expenses, the consequences resonate beyond their wallets. Chronic health issues left untreated due to cost can impede class attendance, decrease concentration, and – ultimately – impact academic success. A reactive, rather than proactive, approach to health care exacerbates the challenges students face, contributing to stress and burnout in an already demanding environment.

Numbers Behind the Struggle

To put it into perspective, a 2023 survey by the Student Financial Wellness Institute found that 56% of college students reported skipping or delaying medical care due to cost. This statistic underscores a critical gap where the promise of accessible campus health services falls short in practice.

Humor in the Midst: The “Free Health Care” Myth

Can we all just agree that “free health care” on campus is the ultimate oxymoron? Like that mysteriously free coffee that actually costs you three steps away to the vending machine, college health services look affordable but often come with sneaky fees. From small co-pays to pricey prescriptions, the joke’s on forgetful freshmen who think “campus health” means zero charges. At least it keeps the campus staff entertained!

Exploring Insurance Options: Is Campus Coverage Enough?

Many universities require students to enroll in their offered health insurance plan, or at least provide proof of equivalent coverage. However, these plans vary widely in what they cover. For example, a 2023 comparison of 15 university health insurance policies revealed that 70% had significant limitations on mental health services, specialist visits, and prescription drug coverage, leading many students to incur high out-of-pocket expenses despite being “insured.”

Case Study: Jack’s Journey Through Coverage Confusion

Jack, a 21-year-old engineering major, learned this lesson the hard way. After spraining his ankle playing intramural soccer, he was referred to an off-campus orthopedic specialist. His campus insurance wouldn’t cover the entire visit, and his personal insurance had a high deductible, resulting in a surprise bill of over $600. Jack’s experience is far from unique but illustrates how complicated coverage can inadvertently trap students in financial predicaments.

What Can Be Done? Suggestions for Universities and Students

Improving transparency is the first step. Universities need to provide clear, accessible information about potential health expenses and insurance limitations before students enroll. On the student side, researching and understanding insurance policies thoroughly can prevent unpleasant surprises.

Additionally, expanding subsidies and increasing funding for campus health centers would improve service accessibility and affordability. Universities could also develop partnerships with local providers to offer cost-effective care outside the standard health services umbrella and educate students on financial literacy related to medical expenses.

Concluding Thoughts: The Cost of Silence

Ultimately, the silent toll of campus health expenses undermines student well-being and academic success. By shedding light on these hidden costs, we can start a broader conversation about how colleges structure health services and support students holistically. It’s not just about tuition; it’s about building an environment where health care is truly accessible, affordable, and transparent – securing the foundation for a thriving student body.

References:

- National College Health Association. (2022). Annual Survey on Student Health Services.

- American College Health Association. (2023). Mental Health and Financial Barriers Report.

- The Education Trust. (2021). Transparency in College Health Service Costs.

- Student Financial Wellness Institute. (2023). Survey on Medical Care and Student Financial Health.