Related Articles

- 7 Game-Changing Student Budget Apps Released Since 2019 That Slash College Living Expenses

- The Silent Toll of Campus Health Services: Unpacking the Overlooked Expenses Students Face Beyond Tuition

- Examining Virtual Tour Accessibility Challenges for Neurodiverse and Disabled Students in Higher Education

- The Role of Virtual Campus Visits in Shaping Student Identity and Community Belonging from Afar

- How Procrastination Patterns Shape College Application Outcomes: Analyzing the Role of Timing in Student Decisions

- How Seasonal Patterns Influence Decision-Making Mindsets During Critical College Application Phases

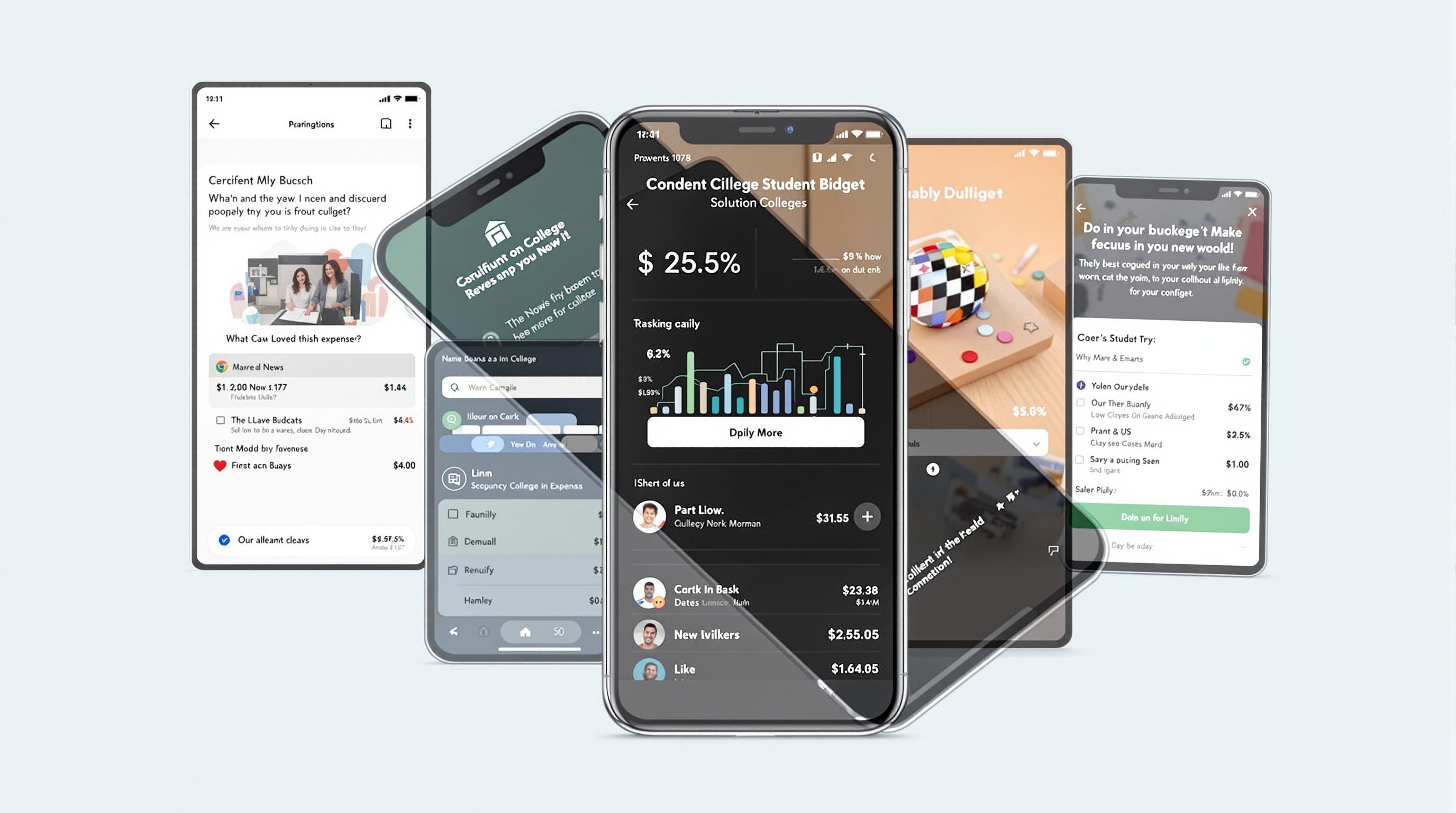

7 Game-Changing Student Budget Apps Released Since 2019 That Slash College Living Expenses

7 Game-Changing Student Budget Apps Released Since 2019 That Slash College Living Expenses

The landscape of college finances has dramatically shifted with innovative student budget apps released since 2019, empowering students to slash living expenses effectively. This article explores seven groundbreaking apps, blending stories, stats, and practical insight to offer strategies for mastering money management on campus.

CashCoach: Teaching Financial Literacy with a Dash of Humor

Meet Alex, a 21-year-old marketing student who, before discovering CashCoach, thought budgeting was just "not spending at all." CashCoach doesn’t just track your expenses—it gamifies the budgeting process with witty reminders and quirky challenges. Since its 2020 debut, it has helped over 1 million college students reduce impulsive spending by 27% on average. Imagine being mildly chided by an app for splurging on yet another late-night pizza, but in a way that makes you chuckle and rethink the purchase. That’s the CashCoach effect.

Personal Capital: The Formal Approach to Long-Term Financial Planning

For college seniors and graduate students who are starting to think beyond tuition and rent, Personal Capital is a comprehensive tool blending expense tracking with investment insight. Founded long before 2019 but significantly updated since, its “retirement planner” feature now includes student debt scenarios that project payoff timelines and savings accumulation. A 2023 survey by StudentFinance.org highlighted that 63% of graduate students using Personal Capital reported improved awareness of their financial health, facilitating smarter debt management decisions.

A Story of Sarah: From Broke to Budget-Savvy

Sarah, a 19-year-old freshman at a state university, was drowning in untracked expenses before installing Splitwise in 2021. Splitwise is perfect for students sharing rent and utilities, simplifying roommate bills and preventing awkward money talks. With it, Sarah saved $300 in six months just by catching miscoded payments and avoiding late fees. Her story highlights how simple group budgeting apps can turnaround financial stress in dorm life.

Zogo Finance’s Bite-Sized Lessons: Learning While Earning

Released in 2019, Zogo Finance appeals to younger learners, combining financial literacy with rewards. The app’s refreshing twist lies in its reward system, where users earn gift cards by completing daily micro-lessons. According to a 2022 study by Education Week, students who actively engaged with gamified finance apps like Zogo showed a 40% increase in knowledge retention compared to traditional lectures. It’s ideal for teens and young adults looking for an entertaining way to bolster money smarts.

Splitwise: The Ultimate App for Shared Expenses

Juggling multiple bills with roommates can be a nightmare, but Splitwise, updated robustly since 2019, elegantly solves this. It tracks who owes what and sends reminders. What makes it indispensable is transparency. John and Mia, freshmen roommates at college, avoided a yearly dispute over utilities simply by syncing their expenses on Splitwise. The app even integrates with PayPal and Venmo, making payments seamless. For students living off-campus, such ease can save not only money but friendships.

Emma: Where Budgeting Meets AI

Emma is a modern financial assistant that uses artificial intelligence to analyze spending habits and spot subscriptions you may have forgotten about. Launched in late 2019, Emma is gaining traction among tech-savvy students who want hassle-free budgeting. A 2021 report by FinTech Magazine noted 33% of users cut down on unnecessary subscriptions within the first two weeks of use. That’s $100+ saved per semester for many students—a compelling reason to embrace smart tech.

YNAB (You Need A Budget): The Old Guard with a Cutting-Edge Update

YNAB has long been a favorite among budget-conscious users, but its 2020 revamp—tailored specifically for the student demographic—adds features like customizable categories for textbooks, meal plans, and transportation. By focusing on proactive budgeting rather than reactive expense tracking, YNAB encourages students to allocate money in advance, increasing financial control. Case in point: a sophomore engineering student reported slashing grocery overspending by 25% within two months of using the YNAB method.

Why These Apps Matter: The Bigger Picture

According to the National Center for Education Statistics, average yearly living expenses for college students increased by nearly 6% between 2019 and 2023. With student loan debts exceeding $1.7 trillion nationwide in 2024 (Federal Reserve), practical budgeting hasn’t just become useful—it’s essential. These apps provide tailored solutions that address unique challenges like shared housing costs, subscription fatigue, and financial anxiety, effectively mitigating some of the stress tied to college expenses.

A Humorous Note on Budgeting

Imagine an app that politely reminds you, “That’s your third iced coffee today—it’s okay, your kidneys deserve a break.” Some of these student budget apps come close to this friendly intervention, helping users set boundaries without feeling guilty. After all, savings don’t have to come from sacrificing all joy—just a bit of savvy decision-making in daily habits.

Tips for Maximizing the Benefits of Budget Apps

One recurrent piece of advice across financial experts and app reviewers: consistency is king. Logging every expense, no matter how small, fuels accurate budgeting. Also, many apps empower users to set personal financial goals, reminding students that budgeting is a means to an end, not just restriction. Combining these apps with habits like meal prepping, buying used textbooks, and careful commuting can lead to dramatic reductions in living expenses over time.

Closing Thoughts from a 35-Year-Old Graduate

Reflecting on my college days spent with scribbled budgets on paper, I marvel at today’s technology. These seven apps do more than track pennies—they educate, motivate, and simplify financial decision-making during one of life’s most financially formative periods. Whether you're a high school senior prepping for college or a seasoned grad student, embracing these tools could transform your financial life and offer peace of mind amid academic demands.

In a world awash with financial challenges, these student budget apps stand as indispensable allies in the quest for affordable, stress-reduced living during college years.