Related Articles

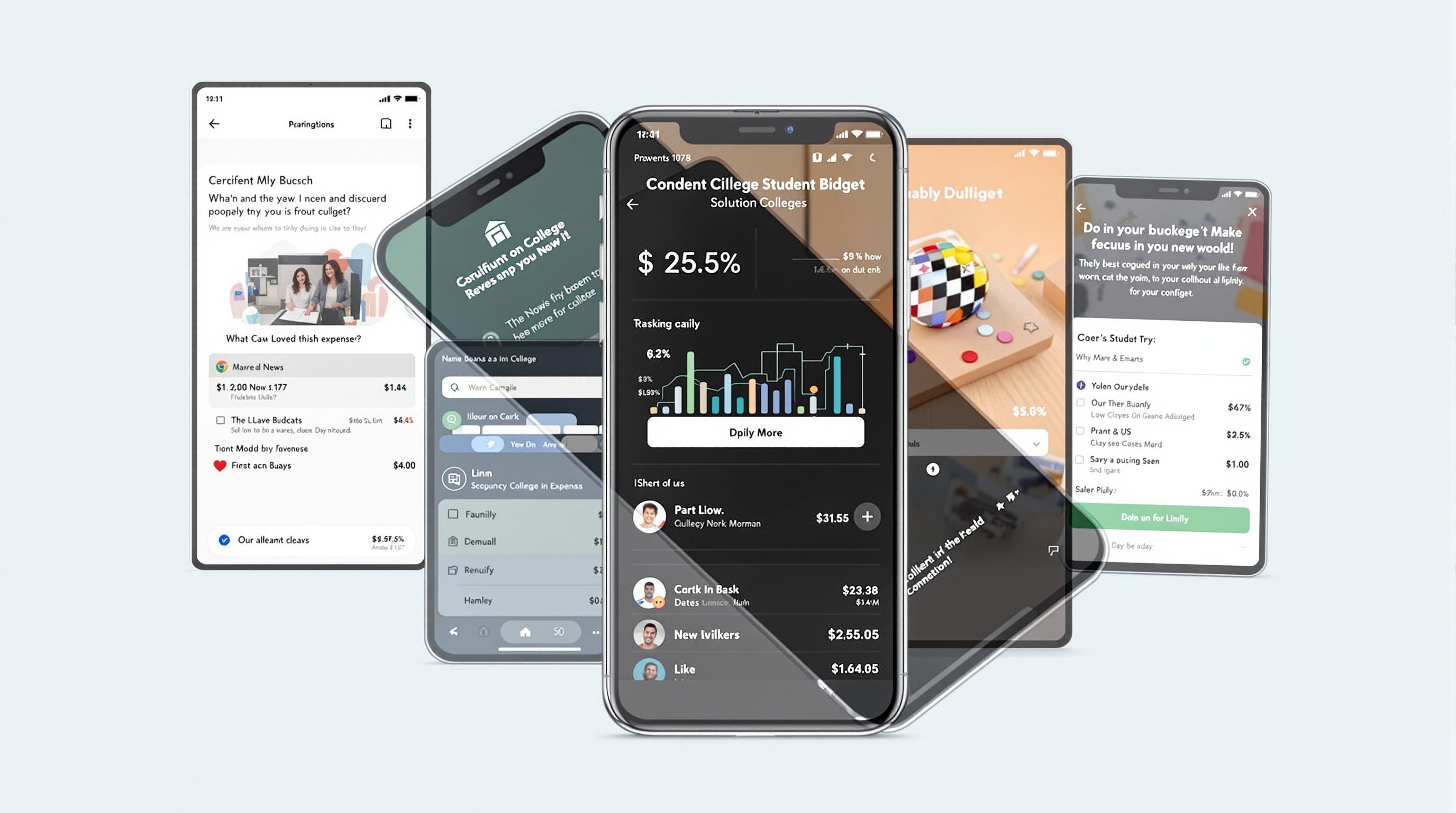

- 7 Game-Changing Student Budget Apps Released Since 2019 That Slash College Living Expenses

- The Silent Toll of Campus Health Services: Unpacking the Overlooked Expenses Students Face Beyond Tuition

- Examining Virtual Tour Accessibility Challenges for Neurodiverse and Disabled Students in Higher Education

- The Role of Virtual Campus Visits in Shaping Student Identity and Community Belonging from Afar

- How Procrastination Patterns Shape College Application Outcomes: Analyzing the Role of Timing in Student Decisions

- How Seasonal Patterns Influence Decision-Making Mindsets During Critical College Application Phases

How Hidden Housing Policies Secretly Inflate Student Expenses and Reshape Campus Life Economics

How Hidden Housing Policies Secretly Inflate Student Expenses and Reshape Campus Life Economics

Hidden housing policies are silently driving up the costs that students face, restructuring the financial landscape of campus life. This article explores the complex ways these policies operate, their economic ripple effects, and real-world examples demonstrating these impacts.

The Invisible Hand Behind Rising Dorm Prices

Imagine being an 22-year-old college junior trying to balance books, rent, and ramen noodles. You might check out your university's housing page and notice a sudden spike in dorm fees. What you don’t realize is that behind those increases, subtle regulations and policy decisions are at play—ones that inflate your expenses beyond what you'd expect from simple maintenance or market demand.

Policies Locking in Limited Supply

Many universities implement strict occupancy rules or zoning restrictions that reduce the potential for expanding on-campus housing. By artificially capping the supply of dorm rooms, prices inevitably rise.

For example, at the University of California system, a 2019 study showed that restrictive campus housing policies contributed to a 15% increase in off-campus rental prices in surrounding neighborhoods, as students were forced to look elsewhere (UCLA Luskin School of Public Affairs, 2019).

Case Study: The Ivy League Effect

Consider Ivy League institutions, where prestige meets exclusivity. Their housing policies often emphasize tradition over affordability, limiting new dorm construction and prioritizing luxury accommodations. This has pushed average housing costs well above national averages for student housing—which was reported at $9,500 per year in 2022 (College Board).

This scarcity fosters competition, leading to all sorts of corner-cutting behaviors—like students doubling up in tiny rooms or foregoing on-campus housing entirely, shifting the economic burden to local rental markets.

“Oh no, not another fee!” - The Fee Factory

It’s easy to miss the way some hidden fees wiggle into the housing cost line. Universities often charge "community fees," maintenance surcharges, or even “technology fees” that aren’t transparently itemized. These small charges can collectively add hundreds to your bill each semester.

Some universities justify this by citing renovations or improvements, but students report that many fees fail to match visible upgrades or service enhancements. Transparency advocates suggest universities could be more upfront about these charges, which, when cumulatively counted, often add up to a hefty 8-12% increase in housing bills annually.

Conversational Break: What’s Up With These Hidden Fees, Anyway?

Okay, picture this: You're chilling in your dorm, and suddenly you get an email about a new “Student Wellness Fee.” You think, "Well, sure, that sounds nice, supportive, whatever." But guess what? It’s tacked onto your housing bill. Surprise! More money out of your pocket. It’s like the fees are multiplying when no one's looking.

The thing is, a lot of these fees originally start with good intentions but get weaponized by tight budgets and bureaucratic processes to patch holes elsewhere. And students get stuck paying.

The Domino Effect on Local Economies

When on-campus housing expenses climb, many students resort to off-campus rentals, increasing demand and prices in local housing markets. Cities with large student populations often witness rent hikes of 10-20% in neighborhoods close to campuses.

For example, in Athens, Georgia, adjacent to the University of Georgia, local rents increased by approximately 18% between 2015 and 2020, partially attributed to tight on-campus housing policies and rising dorm costs (Athens Housing Report, 2021).

Storytime: Maria’s Housing Hunt

Maria, a 19-year-old freshman at a midwestern public university, faced a daunting choice: pay over $7,000 a year for a cramped dorm with a laundry list of hidden fees or hunt for an affordable apartment two miles away.

She chose the apartment, but quickly realized her utility bills, transportation costs, and time spent commuting drained her budget in ways she hadn’t planned. Maria’s story echoes thousands of students caught in the ripple effect of campus housing policies that don’t factor in affordability holistically.

Why Universities Lean Into These Policies

Universities often argue that housing fees fund capital improvements, sustainability projects, and compliance with safety regulations. These are valid concerns; however, many don’t fully weigh how policies indirectly increase student expenses across the board.

One university official commented anonymously, “We have to maintain a delicate balance between financial viability and student affordability, but sometimes the scales tip more toward revenue generation than accessibility.”

Formal Economic Analysis

According to a 2022 economic report by the National Association of Student Housing Economists (NASHE), restrictive campus housing policies contribute to a 7% annual rise in total student living costs. Their models show that even slight caps on dorm room expansions correlate with increased off-campus rent prices and transportation expenses, compounding students’ financial burdens.

A Humorous Take: Dorms, Fees, and the Art of Sneaky Billing

If dorm fees were a sitcom, they’d be "The Secret Surcharge Chronicles." Episode One: The Case of the Mysterious Maintenance Fee. Episode Two: The Phantom Parking Permit. Spoiler alert: every episode involves students scratching their heads and their wallets.

It feels like universities have turned housing into a labyrinthine cost puzzle, where the prize isn’t a diploma but simply making rent on time.

The Psychological Toll on Students

Beyond wallet woes, these financial pressures contribute to stress, mental health struggles, and impaired academic performance. Being forced into financially precarious housing can diminish a student’s ability to focus on studies.

Studies reveal that students paying more than 30% of their income on housing — a growing demographic — face higher rates of anxiety and depressive symptoms (American College Health Association, 2023).

Potential Solutions and Emerging Trends

Some universities are experimenting with innovative policies such as income-based housing fees or expanding affordable living-learning communities. Technology-enabled flexible housing contracts that don’t lock students into year-long leases also show promise.

Moreover, advocacy groups push for transparent billing practices to prevent hidden fees from blindsiding students. In 2023, a coalition of student governments across 25 campuses published an open letter demanding fee transparency and sustainable housing policies.

Wrapping It Up: Shadows in the Housing Ledger

Hidden housing policies aren’t merely a line item increase; they subtly reshape the economics of student life. From restricted supply to sneaky fees to pressure on local markets, they demand greater scrutiny and reform.

For students and stakeholders alike, understanding these dynamics is vital for advocating fairer, more sustainable campus housing solutions.