Related Articles

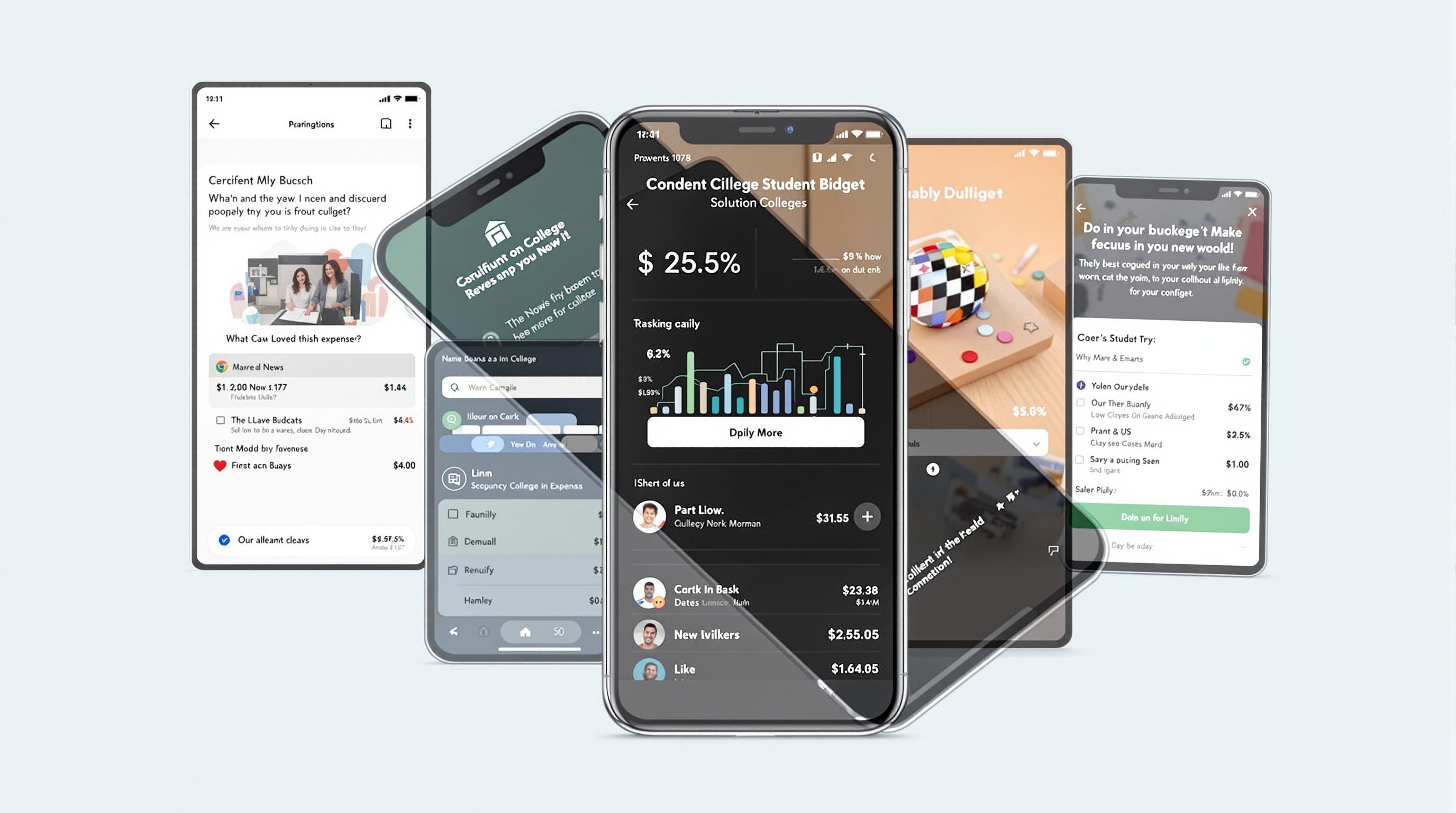

- 7 Game-Changing Student Budget Apps Released Since 2019 That Slash College Living Expenses

- The Silent Toll of Campus Health Services: Unpacking the Overlooked Expenses Students Face Beyond Tuition

- Examining Virtual Tour Accessibility Challenges for Neurodiverse and Disabled Students in Higher Education

- The Role of Virtual Campus Visits in Shaping Student Identity and Community Belonging from Afar

- How Procrastination Patterns Shape College Application Outcomes: Analyzing the Role of Timing in Student Decisions

- How Seasonal Patterns Influence Decision-Making Mindsets During Critical College Application Phases

5 Unexpected Factors Impacting Your College Budget Beyond Tuition and Fees

5 Unexpected Factors Impacting Your College Budget Beyond Tuition and Fees

5 Unexpected Factors Impacting Your College Budget Beyond Tuition and Fees

1. Textbook Costs

Many students underestimate the expense of textbooks when budgeting for college. While tuition and fees are often clear and predictable, textbook prices can vary drastically each semester. New editions, bundled software, and required supplemental materials can drive costs higher than expected.

According to the College Board, the average student spends approximately $1,240 annually on books and supplies. This amount can significantly impact a student’s overall budget, especially for those in specialized programs requiring multiple or costly texts.

To manage these expenses, students can explore renting textbooks, buying used books, or utilizing library resources when available. Digital versions and open-source materials also provide more affordable alternatives that can ease financial pressure.

2. Housing and Utilities

Housing costs extend beyond rent or dorm fees. Students living off-campus will need to consider utility bills for electricity, water, internet, and possibly gas. These additional monthly expenses can add up quickly if not planned for in advance.

Even on-campus housing might have hidden costs, such as meal plans or mandatory fees for cleaning and maintenance. These are often included in dorm fees but should be reviewed carefully to understand the total financial commitment.

Sharing housing with roommates and budgeting carefully can reduce the impact. Always research the average utility costs in your college town, as variations could significantly affect your monthly expenses.

3. Transportation

Whether commuting locally or returning home during breaks, transportation costs often slip under the radar for many college students. Factors such as gas, parking permits, public transit passes, maintenance, and occasional flights can add unexpected costs.

Students who live on campus may feel less impact day-to-day but should still plan for breaks, emergencies, or internships that require travel. According to AAA, typical annual driving costs in the U.S. average over $9,000, so budgeting for even a fraction of this is wise for car owners.

Using public transportation, biking, or carpooling are effective strategies to minimize these expenses. Some schools offer discounted transit passes or shuttle services which can also decrease your transportation budget.

4. Healthcare and Insurance

Healthcare expenses can have a significant impact on a college budget, especially for students who are no longer covered by family plans. Many universities require health insurance, and the cost of premiums, copays, and medications can add up quickly.

Students should review whether they can remain on a parent’s insurance plan until age 26 under the Affordable Care Act or if they qualify for university-provided plans. Emergency room visits or ongoing health conditions can further strain finances when unexpected.

Preventive care, routine check-ups, and using campus health services can help control costs. Additionally, understanding how to navigate insurance claims and coverage details can reduce surprise expenses when receiving care off-campus.

5. Personal and Social Expenses

Beyond essential living costs, students often find their budgets strained by personal spending on social activities, clothing, and entertainment. These costs, while seemingly minor, accumulate and can disrupt planned budgets.

College is a time for social development and networking, which sometimes involves dining out, events, or travel. Budgeting intentionally for these experiences helps prevent overspending without missing out on important social interactions.

Setting spending limits, looking for free or low-cost campus events, and cooking meals at home are practical ways to enjoy college life without breaking the bank. Keeping track of all expenses can also spotlight areas where savings are possible.

6. Technology and Software

Most college programs require students to have access to computers, software, or specialized equipment, sometimes at significant cost. While universities often provide computer labs, owning a reliable device is essential for completing assignments and research.

Additional expenses can include paid subscriptions to cloud storage, academic software (e.g., Adobe Creative Suite, statistical packages), or hardware accessories. Many students underestimate these costs when calculating their budgets.

Seeking student discounts, free education versions of software, or refurbished devices can help moderate technology expenses. Always check if your institution offers licensing agreements reducing costs for enrolled students.

7. Meal Plans and Groceries

Before selecting a meal plan, students should investigate the actual value and flexibility offered. Some meal plans can be restrictive or costly relative to buying groceries and preparing meals, especially for those who enjoy cooking.

Living off-campus might come with the additional hassle and cost of grocery shopping, but it can lead to greater control over nutrition and budget. Food waste, dining out habits, and impulse purchases can inflate food expenses.

Balancing meal plan use with occasional home-cooked meals or budgeting a grocery allowance can optimize food costs. Learning basic cooking skills is both financially and health-wise beneficial during college years.

8. Emergency and Miscellaneous Expenses

Unexpected emergencies such as medical issues, sudden travel, or essential repairs can arise during college. Lacking a built-in financial cushion makes these events particularly challenging.

Setting aside a small emergency fund monthly can provide peace of mind and reduce reliance on high-interest credit options. Many financial advisors recommend an emergency fund covering at least 3-6 months of basic expenses.

Miscellaneous expenses like printing, course materials, or personal care items also add up and should be factored into the budget. Regular budget reviews help account for such fluctuating costs to avoid surprises.

9. Internship and Job-Related Costs

Engaging in internships or part-time work can provide valuable experience and income, but associated costs may be overlooked. These can include transportation, professional attire, meals away from home, and sometimes unpaid hours.

Even paid positions might not fully offset the expenses incurred, so realistic budgeting is essential. Students should anticipate what supplies, travel, or special equipment might be needed for their employment or internship roles.

Communicating with supervisors or career services about possible reimbursements or resources can alleviate some costs. Planning ahead by saving specifically for these opportunities can make participation financially viable.

10. Fees for Campus Activities and Clubs

Participation in student organizations, club sports, or cultural activities often requires dues or fees. While these enrich college life and networking, they can add incremental expenses to an already tight budget.

Assessing the value of each activity and prioritizing involvement helps maintain balance between social engagement and financial responsibility. Some clubs may also offer scholarships or fee waivers for students experiencing financial hardship.

Taking advantage of free campus events or volunteering can also build community connections without extra cost. Budgeting for at least some extracurricular involvement supports both personal growth and fiscal awareness.